Your cart is currently empty!

Category: fintech

All recent blog posts about banking and finance as related to technology

-

Become MTN MoMo Agent In Nigeria and Make Money From Mobile Money Services

If you become MTN MoMo agent in Nigeria, you can start making money from mobile money services in Nigeria. When you complete financial transactions for customers, you simply earn mtn MoMo agent commission. So, What is MoMo Agent? Yello Digital Financial Services, “YDFS,” a subsidiary of MTN Nigeria announced the launch of its super-agent network…

Written by

-

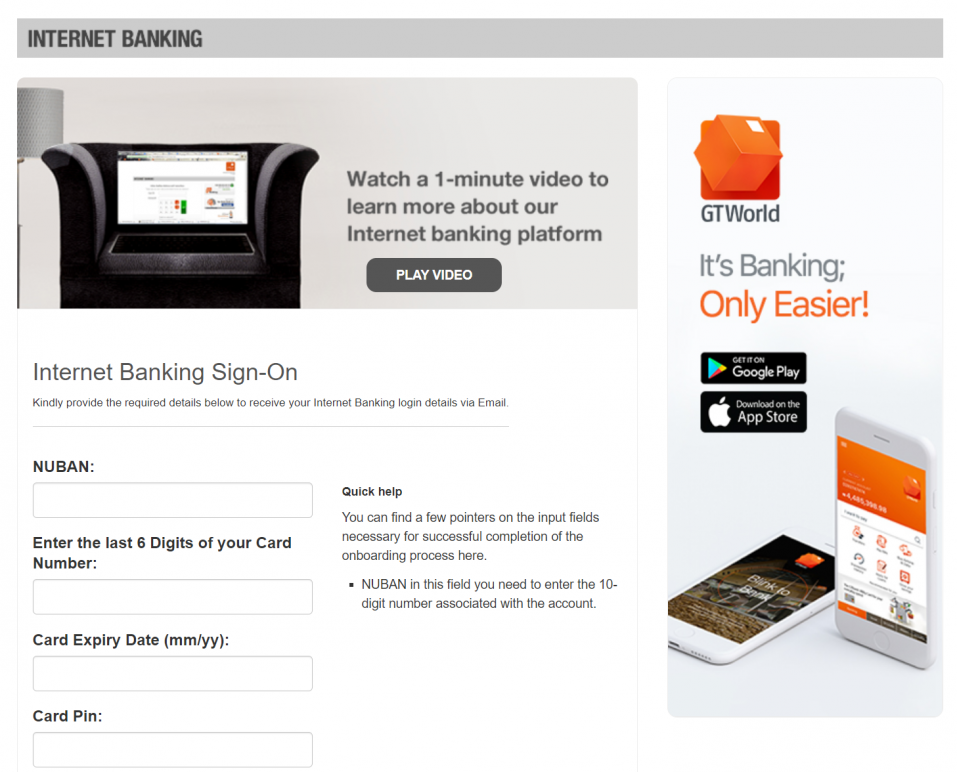

How To Sign Up or Register for GTBank Internet Banking Services in Nigeria

GTBank internet banking offers you a secure way to access your GTBank accounts, manage payments, check your bank statements and much more, 24 hours a day. It simply allows you to experience banking from the comfort of your home, at work or abroad, anytime that suits you. If you’re a GTBank account holder, you can…

Written by

-

Pay With Paga Option Now Available via Flutterwave Payment Gateway

Paga, a Nigerian Fintech company said it has collaborated with Flutterwave, an international Merchant payments platform to support simple and secure one-click payments for Paga wallet users at any merchant where the Flutterwave gateway is enabled. Following the partnership, merchants that are using the Flutterwave payment gateway to receive online payments can now enable “Pay…

Written by

-

CBN Covid19 Loan for Households and MSMEs in Nigeria : How To Apply

CBN covid19 loan for households and Micro, Small and Medium Enterprises (MSMEs) in Nigeria is a stimulus package to support them especially those whose economic activities have been significantly disrupted by the COVID-19 pandemic. The Coronavirus Disease (COVID-19) pandemic has led to unprecedented disruptions to global supply chains, sharp drop in global crude oil prices,…

Written by

-

COVID-19: Rosabon Announces N6M Collateral-Free Loan for Civil Servants in Nigeria

Rosabon Financial Services, one of Nigeria’s leading Non-Bank Financial Services provider, has announced collateral-free and guarantor-free loans as low as 40,000 Naira and up to 6 Million Naira to cater to civil servants in light of the Coronavirus crisis. This is part of a series of measures being implemented by Rosabon Financial Services to cater…

Written by

-

Paystack Introduces UBA & Sterling Bank USSD Payment Channels

As a business owner, it’s important to be able to accept payment from customers however they prefer to pay. I’m excited to announce the introduction of two new payment options on the Paystack Checkout form. Customers can now pay Nigeria-based merchants using the United Bank for Africa *919# and Sterling Bank *822# USSD channels. This…

Written by

-

Rave Flutterwave Payment Gateway Lets Nigerians Receive Online Payment In Dollars, Naira and Other Foreign Currencies

If you are a business owner, you can now receive online payments in Nigeria using “Rave by Flutterwave” payment gateway even if you do not have a website and have your funds transferred to your bank account. And guess what? With Rave, your customers can pay you online in dollars, Naira and other foreign currencies.…

Written by

-

FlutterWave Alipay Integration To Help Merchants Receive Payments From Alipay Users

San Francisco and Lagos-based fintech startup Flutterwave recently announced it’s partnership with Chinese e-commerce company Alibaba’s Alipay to offer digital payments between Africa and China. The partnership simply aims to help Flutterwave merchants receive payments easily from over 1 billion Alipay users via the Rave Flutterwave payment gateway. The Alipay partnership follows one between Flutterwave…

Written by

-

Register for Konga Merchant Account and Start Receiving Online Payments in Nigeria

If you are a business owner in Nigeria, you can start accepting payments online or in store from your customers by making use of KongaPay if you register to become a KongaPay merchant. KongaPay simply helps Nigerian businesses accept payments from bank accounts, cards & KongaPay account and payout to sub-merchants in the case of…

Written by

-

You Can Now Accept Online Payments in Nigeria With Paystack Without Business Registration

Paystack has announced the launch of Paystack Starter Businesses, a merchant tier that allows businesses in Nigeria to start accepting online payments with Paystack without the need for a corporate bank account or company registration certificate. With Paystack Starter Businesses, Paystack seeks to support merchants from every stage of their growth story – from when…

Written by