Your cart is currently empty!

JTB TIN Registration Portal Replaced With Nigerian Tax ID Portal: Key Updates for Taxpayers

·

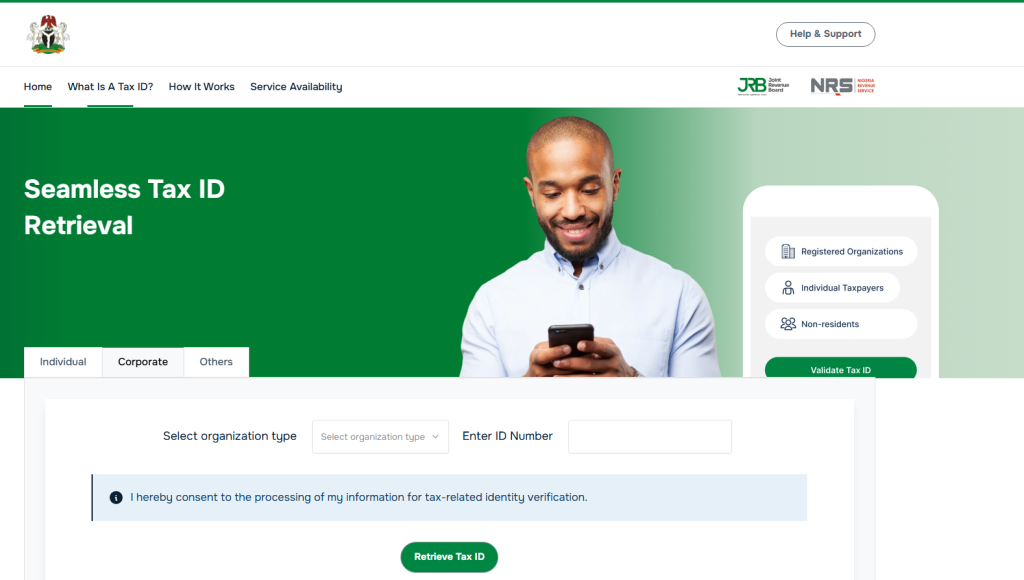

Nigeria’s tax administration system has entered a new and transformative era. In a landmark move aimed at simplifying tax compliance, eliminating duplication and strengthening revenue administration, the Joint Revenue Board (JRB) and the Nigeria Revenue Service (NRS) officially launched the Nigerian Tax ID Portal as replacement for the joint tax board JTB TIN Registration Portal, as part of their collaborative effort to modernize and streamline tax administration.

This is a direct outcome of sweeping tax reforms, institutional restructuring, and the historic transition of the Federal Inland Revenue Service (FIRS) into the Nigeria Revenue Service (NRS). As of January 1, 2026, Nigerians are no longer dealing with the traditional TIN system as they once knew it.

If you are an individual, a business owner, a company director, a cooperative society, a startup founder, or someone who accesses financial services in Nigeria, this change affects you.

Background: How Joint Tax Board TIN Registration Worked in Nigeria Before 2026

Before the introduction of the Nigerian Tax ID Portal, Tax Identification Numbers (TINs) in Nigeria were issued through the Joint Tax Board TIN Registration Portal, accessible via:

This portal served as the official platform for registering and issuing TINs to both individuals and non-individual entities across Nigeria.

JTB TIN Registration for Individuals (Before 2026)

Previously, individuals could apply for a TIN online using any of the following identifiers:

- Bank Verification Number (BVN)

- National Identification Number (NIN)

Applicants were required to fill in personal details, after which their information would be verified. Once approved, the TIN certificate was generated and sent automatically to the registered email address.

JTB TIN Registration for Non-Individuals (Before 2026)

The same portal also catered to non-individual entities, including:

- Limited Liability Companies (LLCs)

- Enterprises (Business Names)

- Incorporated Trustees

For these entities, registration was done using the CAC Registration Number (RC) or Business Name Number, depending on the entity type.

While this system worked, it was not without its challenges.

Introduction of the Nigerian Tax ID Portal

As part of ongoing efforts to modernize and streamline tax administration in Nigeria, the Joint Tax Board (JTB) and the Nigeria Revenue Service (NRS) officially launched the Nigerian Tax ID Portal.

This portal replaces the old TIN registration framework with a single, harmonised national Tax Identification system.

What Happened to the Old JTB TIN Registration Portal?

From 2026 onward:

Visiting https://tin.jtb.gov.ng automatically redirects users to:

This redirection confirms that the old TIN portal has been fully integrated into the new Tax ID infrastructure.

The Nigerian Tax ID Portal Goes Live: Effective January 1, 2026

The Nigerian Tax ID Portal officially went live on January 1, 2026.

From this date:

- The new Tax ID replaces previously issued TINs.

- All tax-related identification is now handled through the Tax ID system.

- Financial institutions and government agencies will require a Tax ID instead of the old TIN.

This marks a decisive shift in how tax identification works in Nigeria.

How the New Nigerian Tax ID System Works

The new system is built on existing national identity databases, ensuring accuracy, uniqueness, and ease of use.

For individual taxpayers:

- The National Identification Number (NIN) is now the primary identifier

- Tax IDs are generated using verified NIN data from NIMC

Information Required to Generate Tax ID (Individuals)

On the Nigerian Tax ID Portal, individuals must enter:

- National Identification Number (NIN)

- First Name (exactly as captured by NIMC)

- Last Name (exactly as captured by NIMC)

- Date of Birth (as captured by NIMC)

Any mismatch may prevent successful Tax ID generation.

For Non-Individuals: CAC Registration-Based Tax ID

For businesses and registered entities:

The CAC Registration Number (RC) serves as the unique identifier

This applies to :

- Limited Liability Companies

- Business Names (Enterprises)

- Incorporated Trustees etc

Once entered and verified, the system generates a 13-digit Tax ID.

Role of NIMC in the New Tax ID System

The National Identity Management Commission (NIMC) plays a crucial role by:

- Providing verified NIN data

- Ensuring accurate identity matching

- Reducing identity fraud and duplication

This integration is one of the strongest features of the new system.

How to Access the Nigerian Tax ID Portal

The Nigerian Tax ID Portal can be accessed via:

Both links lead to the same unified platform.

Availability and Support

The Nigerian Tax ID Portal is now live nationwide.

For assistance, taxpayers are encouraged to:

- Visit the portal directly

- Contact their nearest tax office

- Reach out to state internal revenue services

Final Call to Action for Taxpayers In Nigeria

The replacement of the JTB TIN Registration Portal with the Nigerian Tax ID Portal represents more than a technical change—it is a structural reform with long-term implications.

By leveraging NIN and CAC data and aligning with broader economic reforms, Nigeria is laying the foundation for a simpler, fairer and more inclusive tax system.

For individuals and businesses alike, understanding and adapting to this change early will ensure smooth compliance and uninterrupted access to financial and government services.

Don’t be left behind in 2026. Visit the Nigerian Tax ID Portal today and generate your TAX ID.

Like What You Read?

Sign Up to get similar articles delivered to your email inbox.

Leave a Reply