Your cart is currently empty!

Tax Information for Amazon Affiliates In Nigeria

Are you an amazon affiliate in Nigeria wondering how to complete the tax information required by amazon? You’re not alone.

There are many Nigerian amazon affiliates struggling with this very important step. I can’t count how many times that I’ve received emails as regards to this tax issue. And you know what, it’s either you complete the tax information or Amazon will withhold your amazon affiliate earnings.

Guess what?

If you’re a Nigerian, you don’t even need to provide formal tax information since you are not a US citizen or resident. In fact, amazon successfully validated my tax information without providing my Nigerian TIN (Tax Identification Number).

Below is a summary of the steps taken to complete my amazon associates tax information in Nigeria :

Tax Information Interview

In the tax information interview section; I completed the interview as stated below:

Who will receive income from Amazon or its subsidiary? – individual

For U.S. tax purposes, are you a U.S. person? – no

Are you acting as an intermediary agent, or other person receiving payment on behalf of another person or as a flow-through entity? – no

Tax Identity Information

In the tax identity information section, I completed the interview as stated below:

Entered my full name

Selected “Nigeria” as country of residence

De-Selected “I have a Non-US TIN”

Selected “I could not/have not obtained TIN from my local authorities because of other reasons“.

Clicked “Continue”

Set “location of services perfumed” to : All services will be performed outside the U.S.

Accepted agreement/consent..

Entered my full name as “signature”

Clicked Save > Preview > Submit

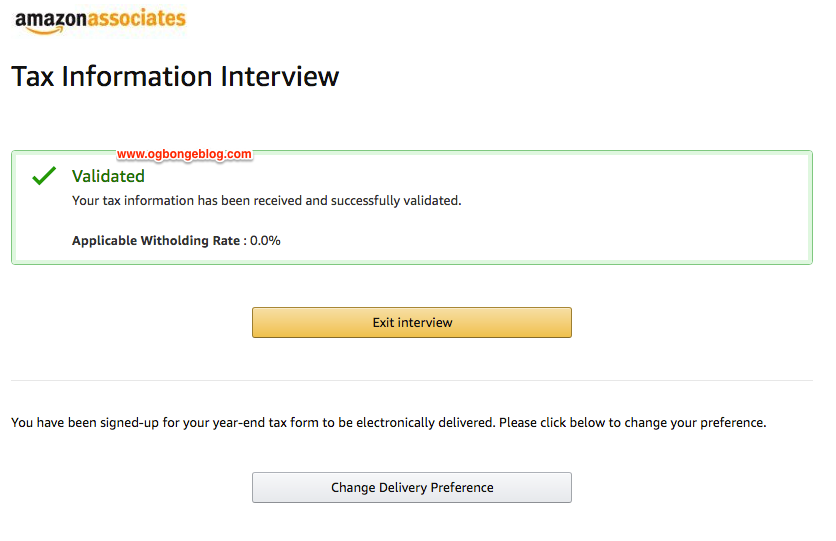

Here is what was displayed after successful validation :

“Exit interview” to continue to amazon associates dashboard.

Happy Selling!

NB : If you a non-US citizen wondering what you should enter as amazon associates tax information, you can follow through the steps above.

Like What You Read?

Sign Up to get similar articles delivered to your email inbox.

10 responses to “Tax Information for Amazon Affiliates In Nigeria”

-

Thanks Alot.

-

Does this applies to those who chose to receive their earnings via payoneer?

-

Thanks a lot brother!

This was simply straight to the point.

-

-

Thanks a lot for this. Your blog is full of value. keep up the good work.

-

Thank you Jide for this post, I recently felt like trying out Amazon affiliate program and every step was flowing well until I got to the point of OTP verification and the Tax information, I quickly run to your blog for solution. Thanks a lot. For the OTP I used the Mosh Number App.

-

thanks Jide.

i followed the procedures here but the 30% withholding tax is still there.i didn’t see an option to set All services will be performed outside the U.S

-

i’m see 30% applicable withholding rate, how fair it? i feel the rate is too high, how can i reduce it?

-

Great, but I think is different now. Have you received the latest mail from Amazon asking content publishers to review their tax information? Now asking to fill in “I have a Non-US TIN” or, affiliates will lose 30% reduction.

Have you seen this yet?

-

Thanks a lot…. exactly what I needed.

-

Thanks for your information. I followed the steps you provided by at the end Amazon is withholding 30% as tax payment. Please what can i do about this?

Leave a Reply