Your cart is currently empty!

Tag: loans

-

CBN Covid19 Loan for Households and MSMEs in Nigeria : How To Apply

CBN covid19 loan for households and Micro, Small and Medium Enterprises (MSMEs) in Nigeria is a stimulus package to support them especially those whose economic activities have been significantly disrupted by the COVID-19 pandemic. The Coronavirus Disease (COVID-19) pandemic has led to unprecedented disruptions to global supply chains, sharp drop in global crude oil prices,…

Written by

-

COVID-19: Rosabon Announces N6M Collateral-Free Loan for Civil Servants in Nigeria

Rosabon Financial Services, one of Nigeria’s leading Non-Bank Financial Services provider, has announced collateral-free and guarantor-free loans as low as 40,000 Naira and up to 6 Million Naira to cater to civil servants in light of the Coronavirus crisis. This is part of a series of measures being implemented by Rosabon Financial Services to cater…

Written by

-

How To Request for Quickteller Loan

If you need a quick short-term loan, then you can request quickteller loan. Hassle-free, instant loans are accessible on the Quickteller platform via Quickteller loans. You do not need collateral or a guarantor in other to apply for quickteller loan in Nigeria Customers who seek quick loans to solve urgent needs, can access up to…

Written by

-

TraderLite by Access Bank Helps Traders In Nigeria Enjoy Convenience and Easy Access to Loans

In a bid to help traders in Nigeria carry out transactions without delays and also enjoy easy access to loans, Nigeria’s leading retail bank, Access bank plc has launched TraderLite, an account that enables micro-businesses, with turnover between N50, 000 – N1Million, operate their businesses with their individual name or registered business name. Speaking at…

Written by

-

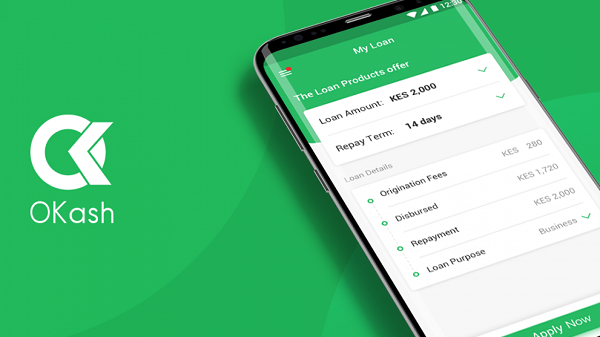

How To Repay OKash Loan In Nigeria

In this post, I want to quickly share with you how to re pay okash loan in Nigeria after you might have apply to get okash loan in Nigeria. Android smartphone users that want to get Okash loan can download OKash loan app from Google Play and set up their account in seconds by filling…

Written by

-

OKash Loan App in Nigeria Lets You Apply for Loans in Seconds

Originally integrated into the OPay mobile app, OKash personal loan app is a stand-alone mobile app that provides users access to short-term loans at their fingertips. OKash first launched in Kenya but expanded to Nigeria and India. So, OKash Loan app in Nigeria enables Nigerians apply for personal loans in seconds without collateral. The app…

Written by

-

CBN AGSMEIS Loan 2019 : How To Apply Without Collateral

CBN AGSMEIS Loan 2019 application is in progress as at the time of publishing this post. You can access up to N10M at 5% per annum from the Agric, Small and medium enterprise scheme (AGSMEIS), an initiative from Central Bank of Nigeria (CBN) – without collateral. AGSMEIS is an initiative of the Bankers’ Committee in…

Written by

-

How To Apply For Trader Moni Loan In Nigeria

If you want to benefit from the Federal Government trader moni boi project, you will have to first go through a trader moni registration process. Unlike Market Moni registration which requires you belong to an accredited market association or cooperative, all you have to do is to find a trader moni agent in your state…

Written by

-

Conditional Cash Transfer Programme in Nigeria

Many poor and vulnerable households in Nigeria scheme are benefiting from the Conditional Cash Transfer scheme of the Federal Government funded Social Investment Programme, which is giving N5000 a month to some of the poorest Nigerians across the country. The beneficiaries get N5, 000 per month, get trained to be able to do business and also…

Written by

-

Market Moni Loan Repayment : How It Works

Market Moni loan scheme is a social intervention programme granting interest-free credit facilities to existing microenterprises of market women and traders, artisans, enterprising youth and agricultural workers. The scheme of the National Social Investment Office is an initiative targeted at expanding the scope and scale of economic opportunity for the financially vulnerable. The Federal Government…

Written by